🔎 Quantitative Analytics: How we transformed market noise into signals

The TradeAx team has rebooted the very concept of data analysis. Our technology doesn't just count volumes - it deciphers the DNA of the market, showing who, when and under what conditions controls the price.

✨ What only we know:

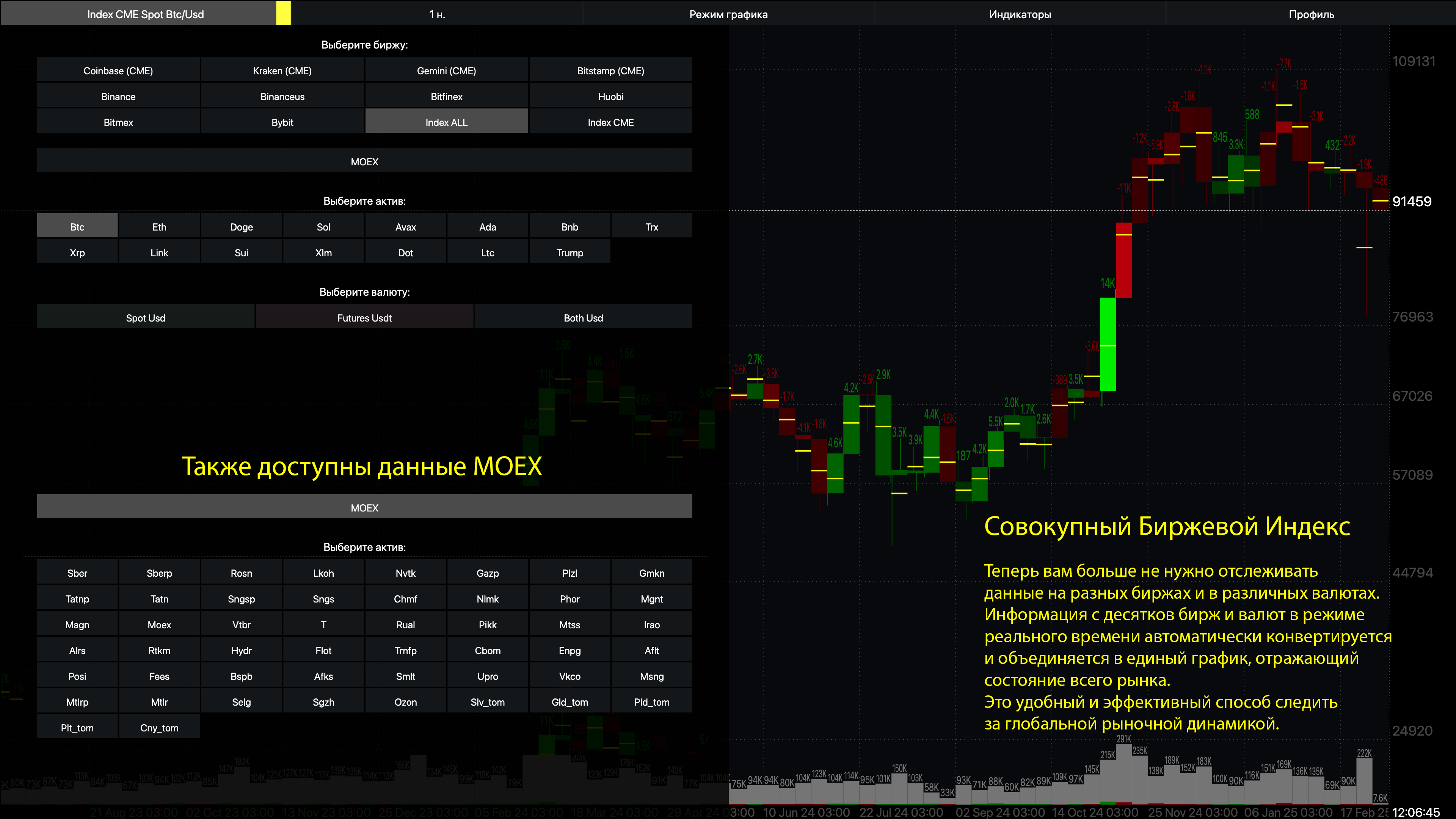

Global market pulse instead of local data:

We aggregate information from most of the world's largest exchanges in real time and create aggregate asset indices.

For an asset like BTC/USD this means:

- Analysis of all trades from major exchanges across all currency pairs (BTC/USD, BTC/EUR, BTC/GBP, BTC/JPY...) and their conversion into a single index

- Aggregate Exchange Index - a unified chart combining spot and futures.

- Ability to see where large players are actually accumulating positions - even if it's hidden on local exchanges.

Opening price vs. real liquidity: Our algorithm distinguishes "empty" levels from zones where real orders are concentrated (even hidden ones).

Weighted average position price - shows where real orders are concentrated, in which accumulation/distribution phase the asset is.

🤝 This is not analytics. This is market X-ray.

While others give you "numbers" from a separate exchange, we show the logic of big capital on a global scale. TradeAx is the only platform where:

- Data from Asia, Europe and the US merge into an Aggregate Index

- You see not "exchange noise" but true demand and supply

- Quantitative data becomes a ready trading plan